irs child tax credit customer service

You can see your advance payments total in. 52 rows IRS Phone Number.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

The child tax credit is 2000 for.

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

. Customer Service and Human Help Options. Credit for the Elderly or the. Try one of these numbers if any of them makes sense for your.

15 but the millions of payments the IRS has sent out have not. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov.

Missing child tax credit payments. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

The tax credit was originally offered through President Joe Bidens 19 trillion coronavirus relief package. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Child Tax Credit for 2022.

Find answers about advance payments of the 2021 Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Reconciling your Advance Child Tax Credit Payments on your 2021 Tax Return on the IRS website.

Five Myths About Federal Tax Returns Debunked. The government said some families might be leaving up to 3600. Child and Dependent Care Credit Flexible Benefit Plans.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. For more details see Topic H. The IRS maintains a range of other phone numbers for departments and services that deal with specific issues.

Choose the location nearest to you and select Make Appointment. The Child Tax Credit Update Portal is no longer available. In that case contacting the IRS by phone can get you the help you need.

Learn more about this topic. Top Tips for Painless Tax Prep Find. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

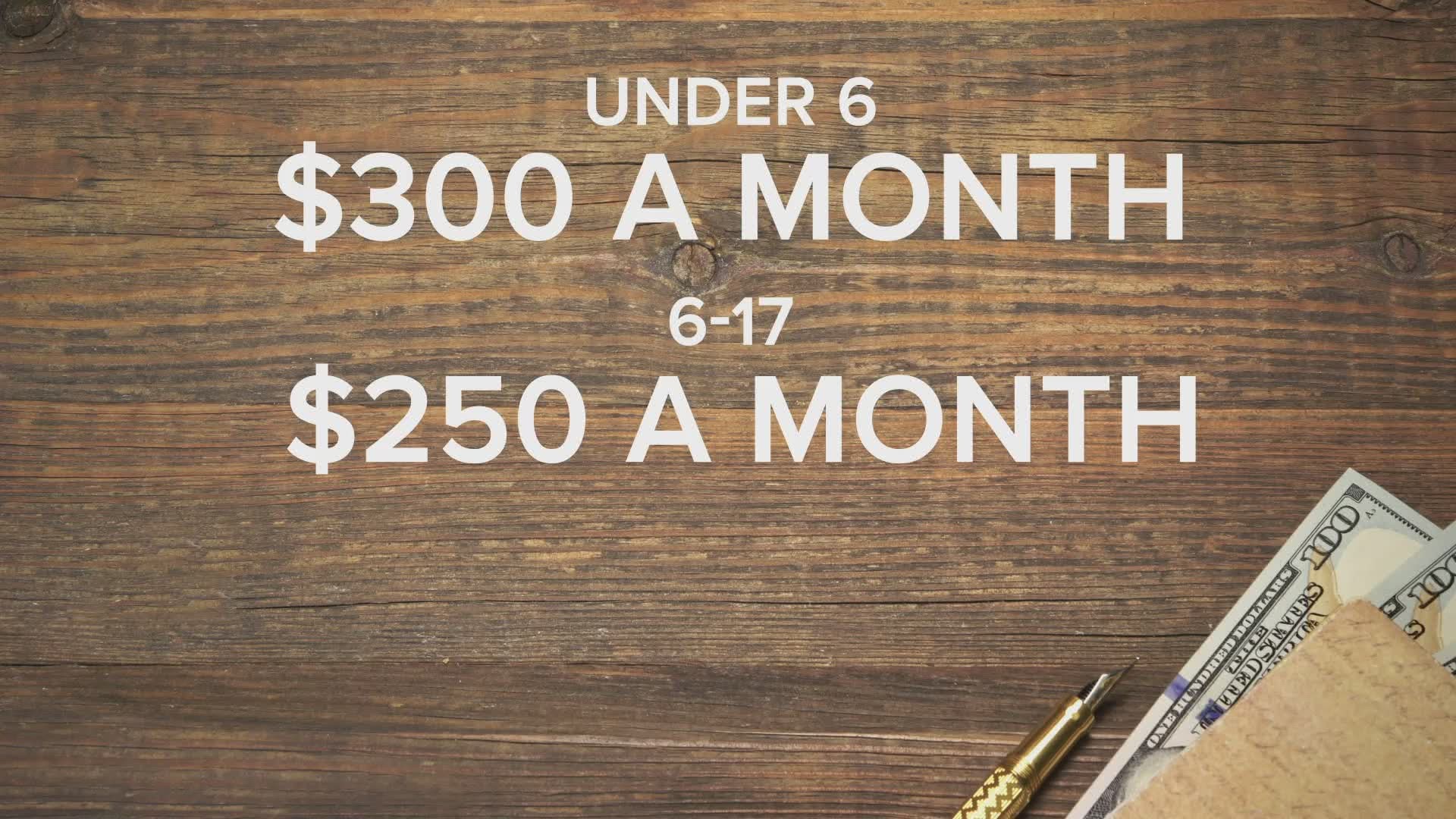

Frequently Asked Question Subcategories for Childcare Credit Other Credits. Only available if you arent required to file a. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

Back to Frequently Asked Questions. The Internal Revenue Service erroneously sent more than 1 billion in child tax credit payments last year to millions of Americans who werent eligible for the free cash an audit. Estate and gift tax questions.

These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. This option is a good choice for people with lower incomes who want a quick and easy way to claim the Child Tax Credit and stimulus payments. Yes you may claim the child tax credit CTCadditional child tax credit ACTCrefundable child tax credit RCTCnonrefundable.

Many families received advance payments of the Child Tax Credit in 2021. It is a tax law resource that takes you through a series of questions and provides you with responses to. Make sure you have the following information on.

Have been a US. 15 but the millions of payments the IRS has sent out have not.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

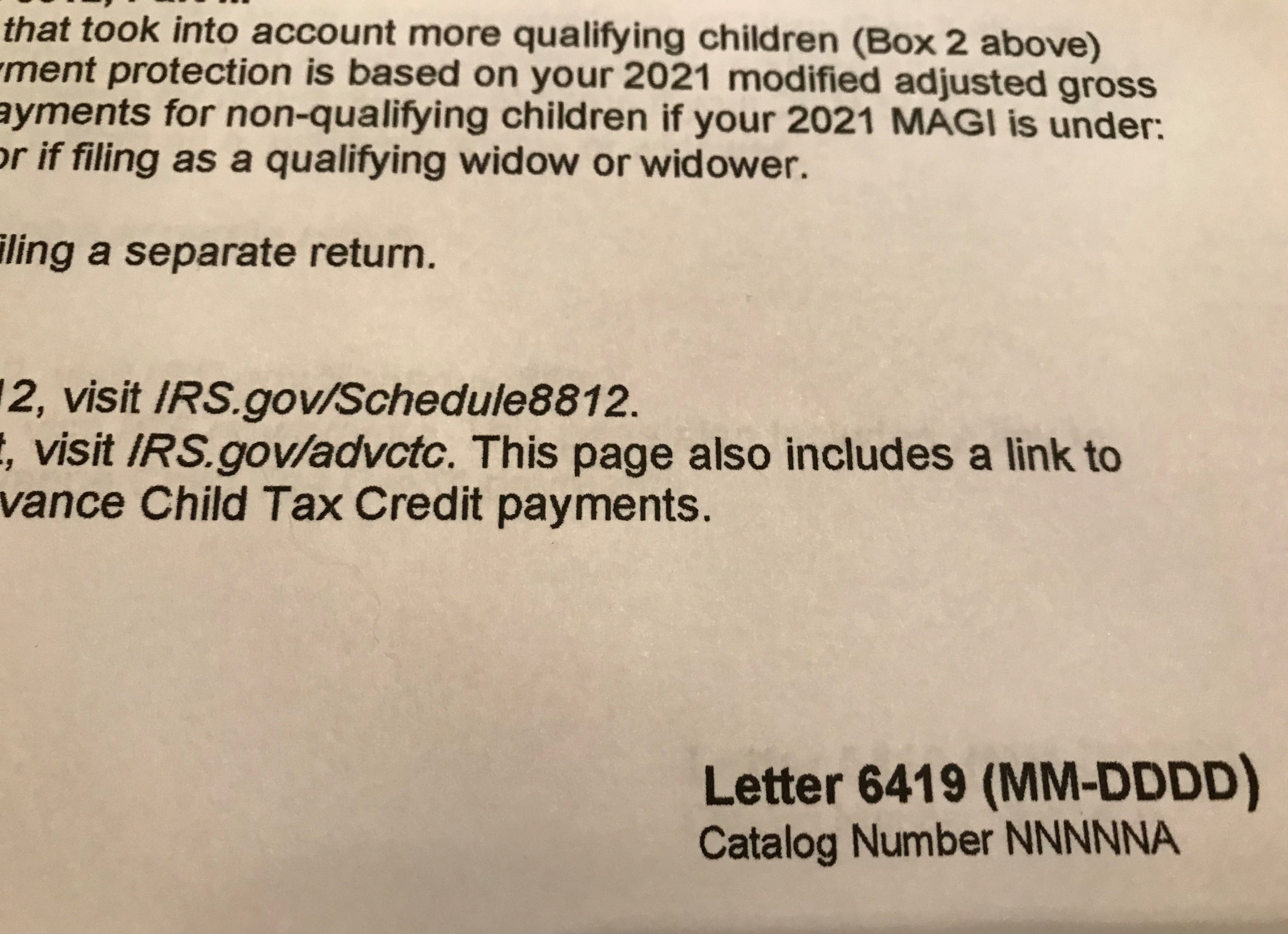

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

Irs Warns Some Taxpayers May Have Received Incorrect Child Tax Credit Letter 6419 Cbs News

Irs Launches New Address Update Feature For Child Tax Credit Payments Maui Now

Irs Wants Millions To Claim Child Tax Credit Stimulus Funds Wkbn Com

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Advance Child Tax Credit Short Or Missing Navigate Housing

Change Address On Child Tax Credit Update Portal Taxing Subjects

2021 Advanced Child Tax Credit What It Means For Your Family

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Child Tax Credit Payment Schedule Here S When To Expect Checks King5 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com